Rental Yield & Mortgage Calculator

Find out how much you can earn from your property investment.

Curious about the return on your property investment? Our Rental Yield & Mortgage Calculator takes the guesswork out of the equation. Just pop in the property value, rent, and your mortgage details, and we'll do the rest.

Not sure about the figures? Enter a postcode, and we’ll fetch the latest property value and average rent in that area for you.

Whether you're a landlord or a property investor, this tool helps you make informed decisions, so you can invest smart and maximise your earnings.

Methodology

The Rental Yield & Mortgage Calculator uses a straightforward formula to help property developers and investors assess the potential profitability of a buy-to-let investment.

By calculating rental yield as a percentage of the property's market value, the tool gives an immediate snapshot of how much income a property could generate relative to its cost.

Additionally, our calculator factors in mortgage payments by incorporating loan amount, interest rate, and loan term to provide a net rental yield. This approach ensures that property developers can see their real estate investment’s true potential, accounting for both rental income and finance costs.

The tool also integrates real-time data, such as UK property prices and average rents, enabling users to make accurate, informed decisions based on the most up-to-date market conditions. Perfect for anyone looking to maximise returns on their buy-to-let properties.

Results:

Gross Yield

--%

(excluding expenses)

Net Yield

--%

(after expenses)

Mortgage

£--

(per month)

Net Yield

--%

(after mortgage)

1 Annual expenses refer to the ongoing costs you’ll need to cover as a property owner or landlord. These can include things like maintenance and repairs, property management fees, insurance, ground rent, and service charges. If the property is mortgaged, you might also want to include mortgage interest payments here.

2 Based on the current Bank of England base rate at 16 July 2025, which they charge other banks and lenders for loans, influencing the cost of borrowing and the return on savings across the UK economy.

Disclaimer

The Rental Yield & Mortgage Calculator is provided for informational purposes only and should not be considered financial advice. The results are based on the data you enter and do not account for all possible expenses or variations in property market conditions.

Real estate investments come with inherent risks, and actual returns may differ from estimates.

We recommend consulting with a qualified financial advisor or property expert before making any investment decisions. Postcode Area is not responsible for any losses incurred as a result of using this tool, or for any inaccuracies when calculating results.

Best Properties for Yield

The following postcodes have the best performing yields as at 16 July 2025:

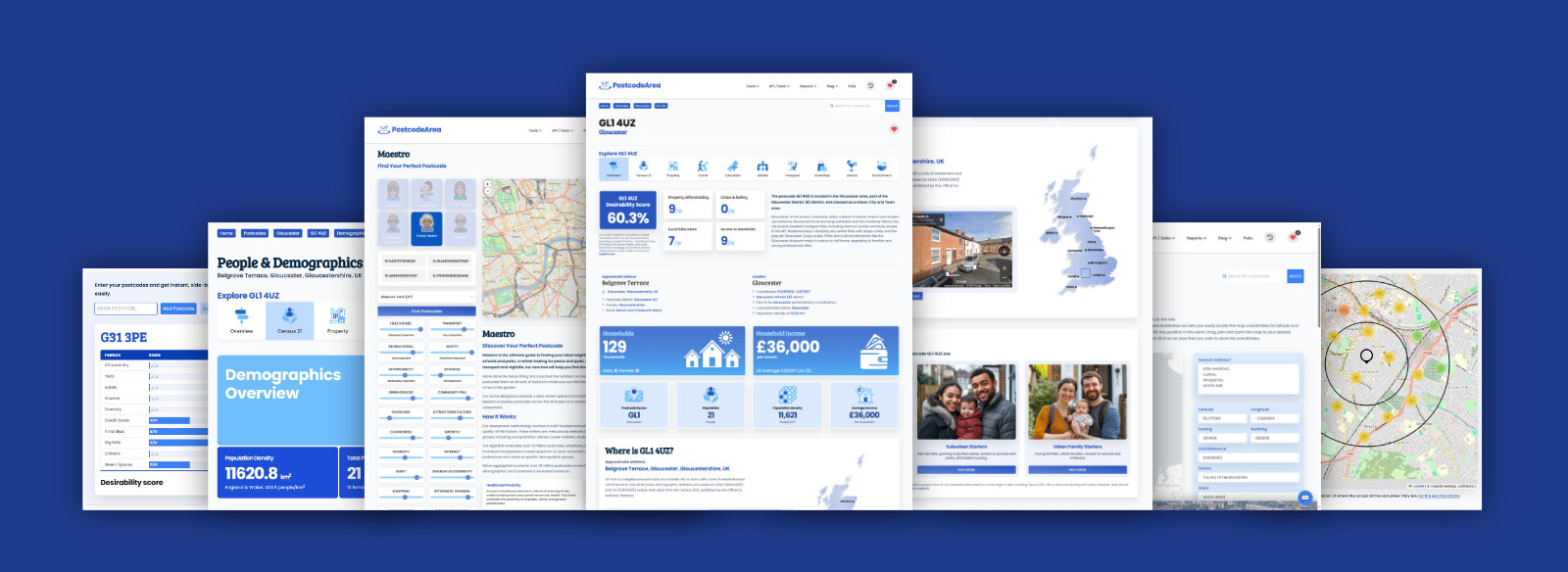

Unlock the full power of postcode insights.

Data is meaningless without context. Reveal the stories behind a neighbourhood, and make smarter decisions with data you can trust. Gain unlimited access to detailed statistics, exclusive reports, and essential tools.

PostcodeArea is grateful to our sponsors for their support.